Payroll Report in Hajir HRMS

Payroll report is one of the most important tools of this digital transformation process as it is a powerful piece of paper that does not only assist in managing salaries but also leads to compliance, transparency, and strategic decision-making.

Fast Onboarding

Secure Cloud-Based

Employee Self-Service

Our Reach

The HR Choice for Businesses Across Every Industry

Across sectors like education, healthcare, technology, and hospitality, Hajir transforms HR management, making it simple, efficient, and employee-friendly.

1600+

Organisations

10000+

Active Users

800+

Payroll Process

100%

System Up Time

Technology

40+

Manufacturer

10+

Financial Services

25+

Hospitality

50+

Healthcare

35+

Education

55+

Retails

25+

Cargo / Shipping

15+

Cooperative

75+

Consultant

35+

Consultancies

100+

Travel Agencies

25+

Construction

25+

Cleaning & Janitorial

17+

Manpower

30+

Food & Beverage

20+

Automotive

20+

Securities/ Broker

5+

Marketing Agency

15+

Real Estate

10+

Media & Entertainment

15+

NGO's / INGO's

10+

Beauty & Cosmetics

5+

Importer & Dealer

15+

Why Payroll Reports Matter for Every Business

Reporting on payrolls is much more than just paper work. They are strategic means that contribute to:

- Transparency and Accountability: A properly prepared payroll report will make sure the payments and allowances of all the employees are properly calculated. It builds trust among the employees, as well as ensuring that the company is in compliance with the labor laws.

- Legal and Tax Compliance: The labor and tax laws in Nepal demand proper documentation of the payment of employees, provident fund (PF), social security fund (SSF) deposits and taxes. A payroll report helps to make this process easier and avoids expensive legal mistakes.

- Accurate Financial Planning: Payroll is one of the biggest expenditures in an organization. Detailed payroll reports can enable the business to predict the costs, budgets and make sound financial decisions.

- Performance and Productivity Insights: Companies are able to use payroll information to understand their overtime, absenteeism, and performance-based incentives – assisting HR executives in optimizing workforce planning.

- Audit Readiness: Payrolls are the main compliance documentation when auditors audit financials. They provide a clear account of all the payments made to the salaries of the employees and deductions and government contributions.

Components of Payroll Report

An average Payroll Report consists of the following:

- Employee Information: Name, Employee ID, department and designation.

- Earnings: Basic pay, allowances, commissions, overtime pay and bonuses.

- Deductions: Taxes, provident fund, insurance, etc.

- Employer Contributions: PF, SSF, gratuity and insurance premiums paid by the employer.

- Net Pay: Final salary that is paid to the bank account of the employee.

- Pay Period and Date: The period of time and date of payment to ensure easy tracking and record keeping.

- Signatures and Authorizations: Compliance to be verified by the HR or financial personnel.

All these elements would make the financial process more transparent and auditable – the one that can be tracked and managed with the help of digital tools such as the Payroll Management System of Hajir HR.

Ready to get started?

Request for demo today!

Challenges of Manual Payroll Reporting

Many Nepal based businesses have traditionally used spreadsheets or manual calculations to calculate payroll. Although it is workable when there are small groups, it can cause:

- Ethical mistakes in calculations of taxes or deductions.

- Every pay cycle is subjected to time-consuming processes.

- There are the compliance risks associated with the lack of records or incorrect data reporting.

- Lack of capability of analyzing data and tracking performance.

Manual reporting is not easily manageable as the number of employees increases. That is why the contemporary businesses are moving to automated payroll systems that can produce payroll reports in few clicks.

Types of Payroll Reports Your Business Should Generate

Employee Payroll Report: This is a report that will contain the earnings and deductions of an individual employee.

Departmental Payroll Summary: Costs of the entire salaries by department or team.

Tax and Compliance Report: Prepares a summary of income tax, SSF, and other deductions, which are submitted in the compliance.

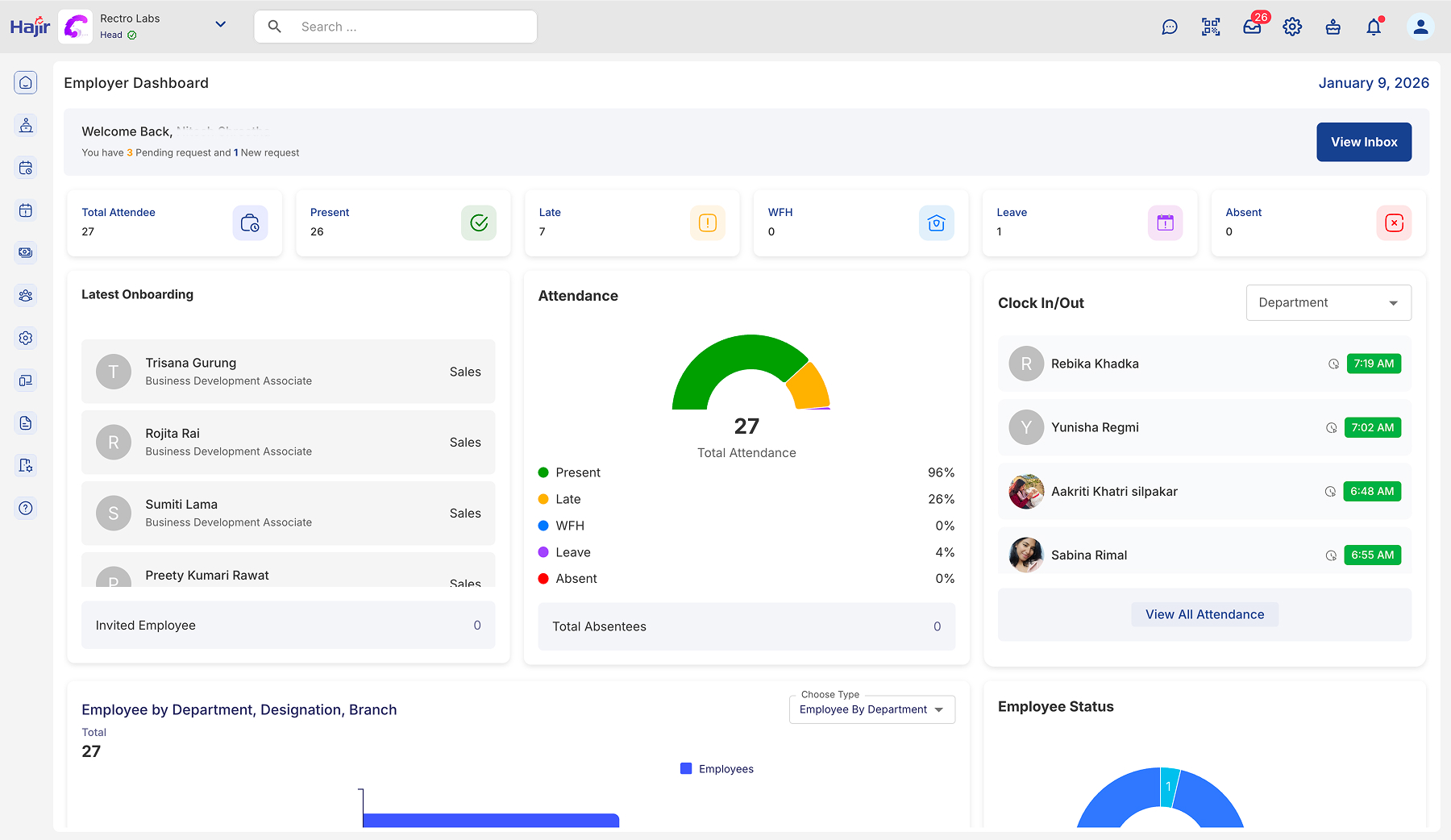

Attendance-Based Payroll Report: This is an integration of attendance and overtime data to payroll results.

Annual Payroll Summary: Gives a year end summary in order to budget, audit and review strategic areas.

Access to these reports assists management to make evidence-based decisions on the use of resources, performance incentives, and workforce plans.

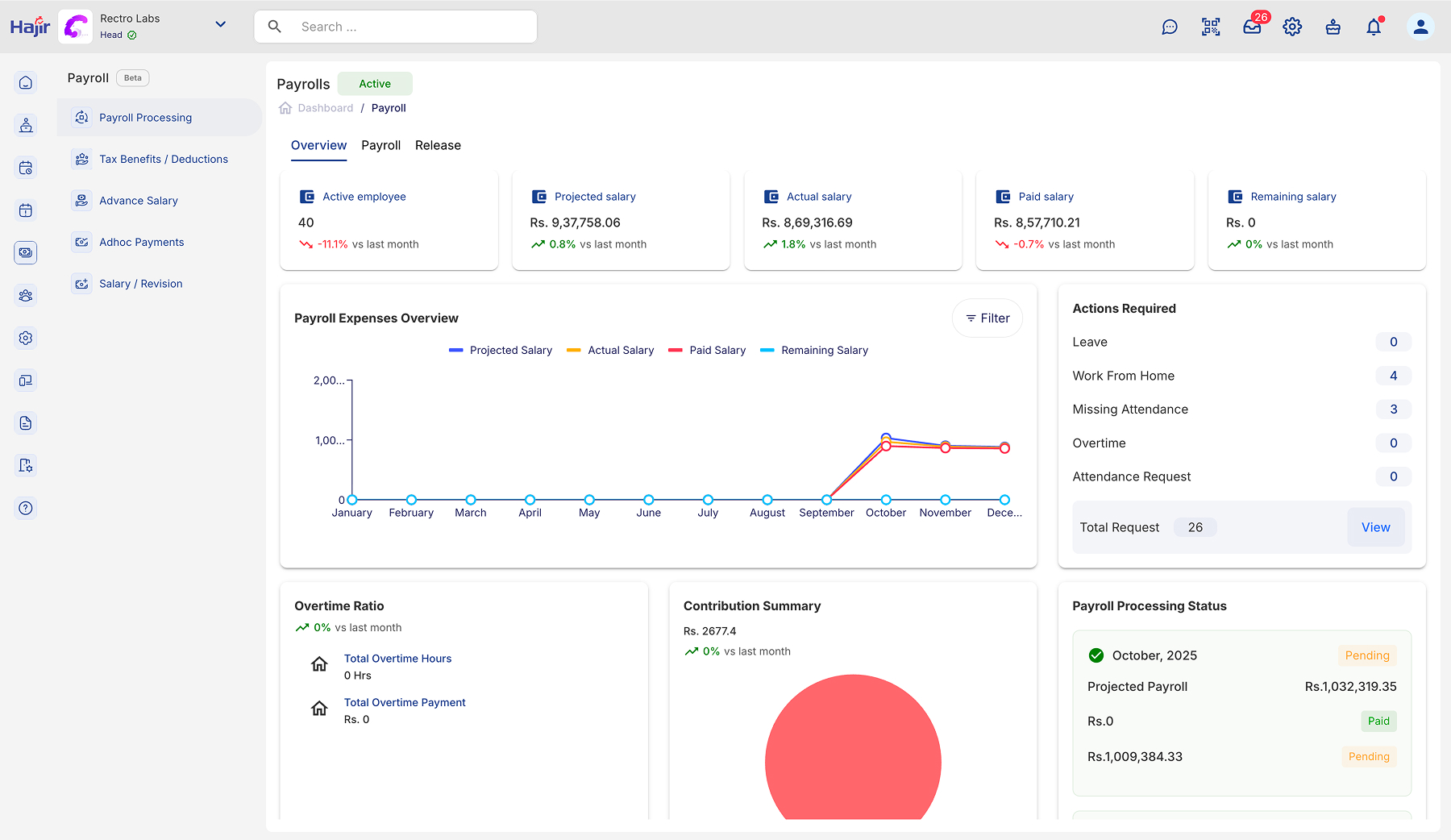

Automating Payroll Reports with Hajir HR

Hajir HR is the combination of automation, accuracy and compliance. Its developed payroll module makes the generation of a payroll report a smooth process that has no errors.

That is the way Payroll Report System of Hajir HR can benefit Nepali business:

- Automatic Expenses and Processing: The salaries, deductions and benefits are automatically determined through pre-established company rules and are computed by the system- removing human mistakes.

- Real-Time Data Integration: The Hajir HR attendance management system attendance data is automatically incorporated in payroll module and ensures that the salaries are calculated based on working hours and leave records.

- Local Compliance: The Hajir HR was developed to meet the requirements of Nepal businesses and follows the labor, tax and social security laws of the country such as SSF and PF payments.

- Payroll Reports can be customized: Businesses are able to create detailed or summary payroll statements, monthly salary sheets, and tax statements as well as departmental breakdowns all in exportable formats ( PDF, excel, CSV).

- Information System Security and Availability: The data concerning all payrolls is safely stored on cloud whereby authorized personnel can still be able to view reports at any location and at any time with strict data privacy protocols.

Best Practices for Accurate Payroll Reporting

- Keep Current Records of Employees: Make sure that all the data of all the employees such as salary revisions and benefits are updated on a regular basis.

- Combine Leave and Attendance Data: Ensure that there are no discrepancies by aligning attendance with payroll.

- Periodically Revise Deductions and Contributions: Remain in compliance with tax policies or social funds policies by government.

- Automate Reports Where Necessary: Automate processes with programs such as Hajir HR in order to minimize errors.

- Periodic Audit Payroll Reports: Conducted regularly, audits assist in the detection of discrepancies at an early stage and will ensure financial accuracy.

A Payroll Report is not a document at all, it is a mirror of the working efficiency, financial discipline and devotion of your company to your employees. With the current data-driven HR environment, a solid payroll reporting system can change the way your organization treats people, compliance and performance.

Using the Payroll Management System offered by Hajir HR, Nepali companies will be able to easily streamline their payroll operations, produce immediate payroll reports, and derive practical insights without going against local rules.